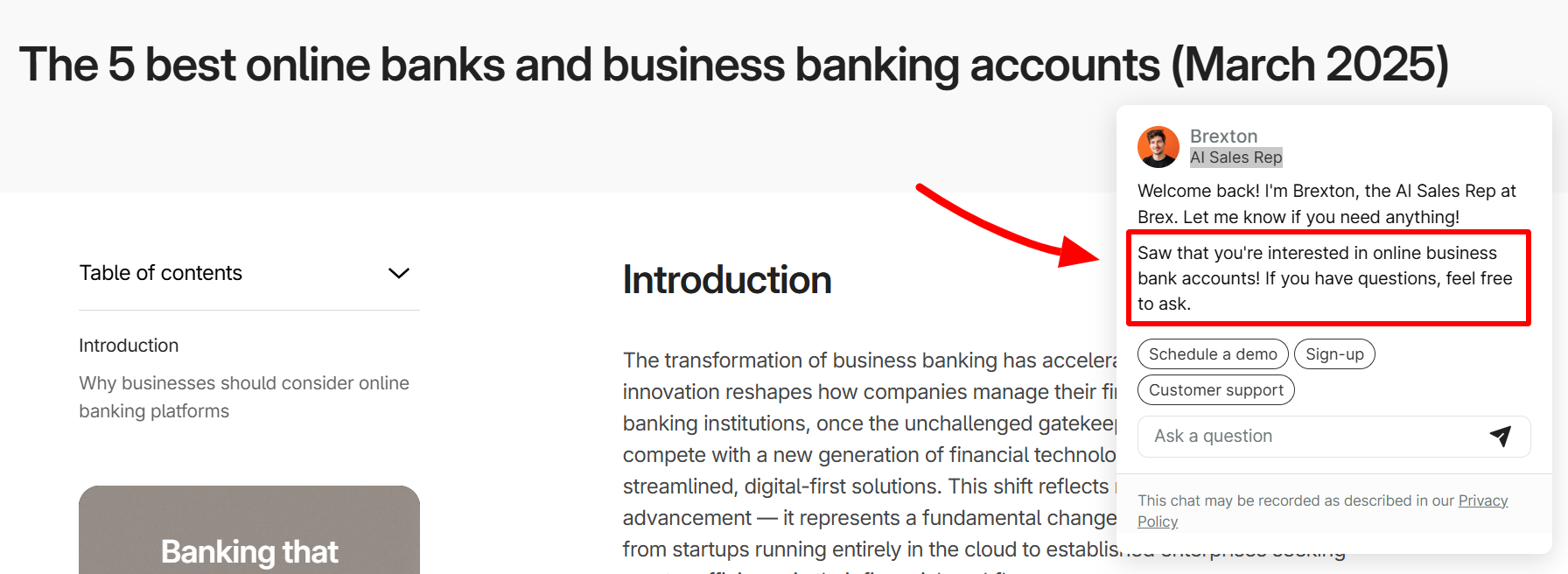

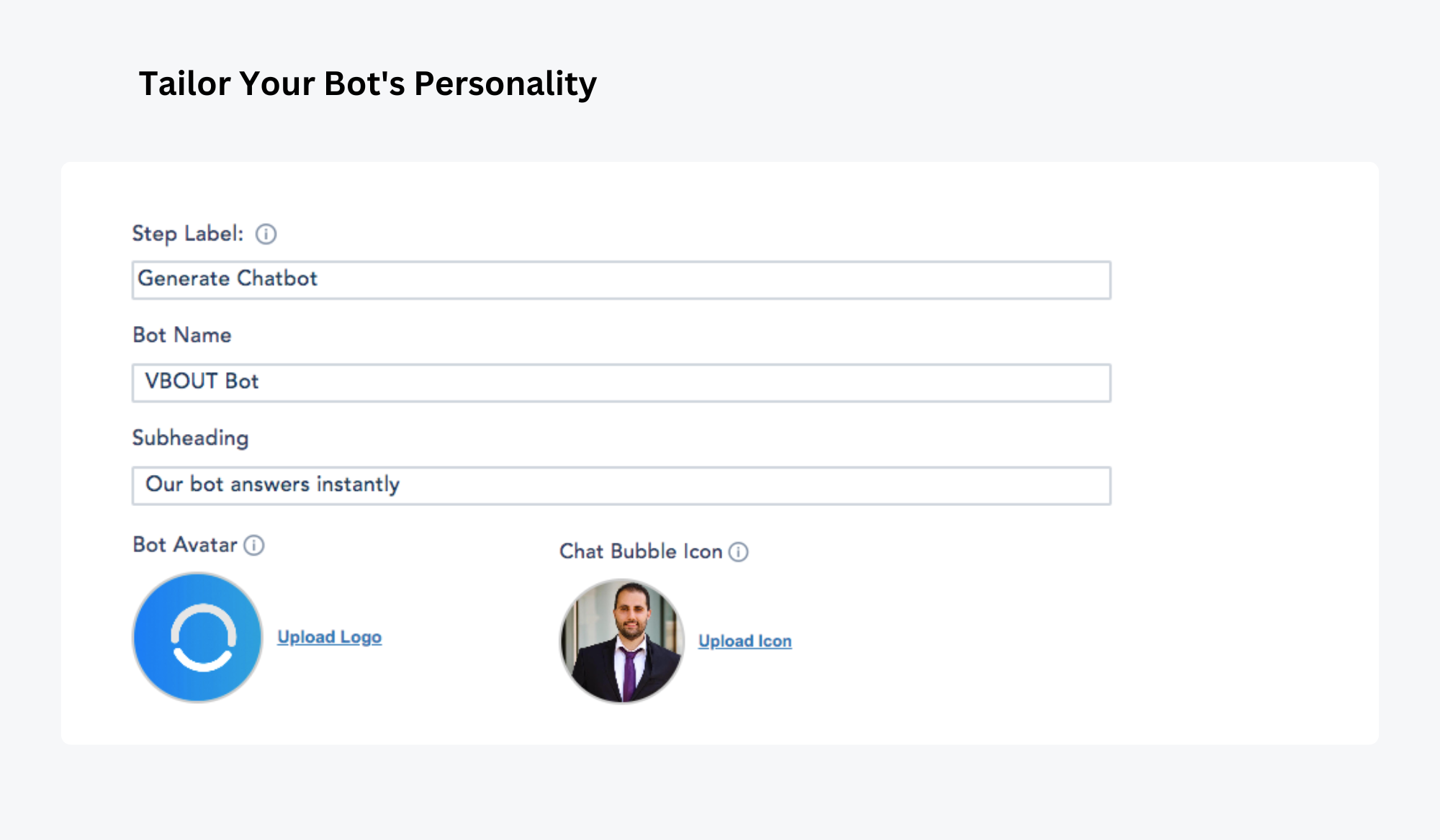

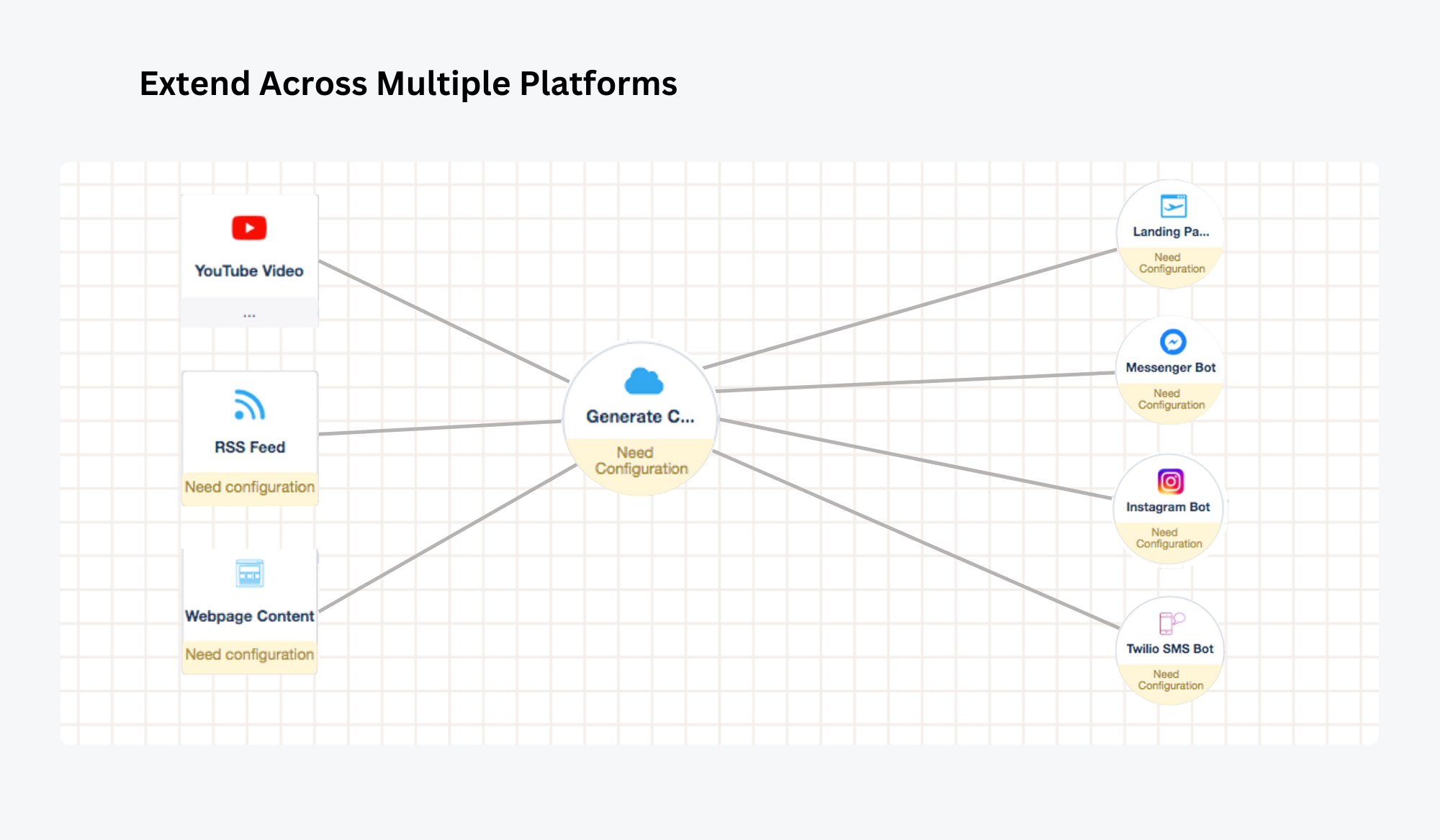

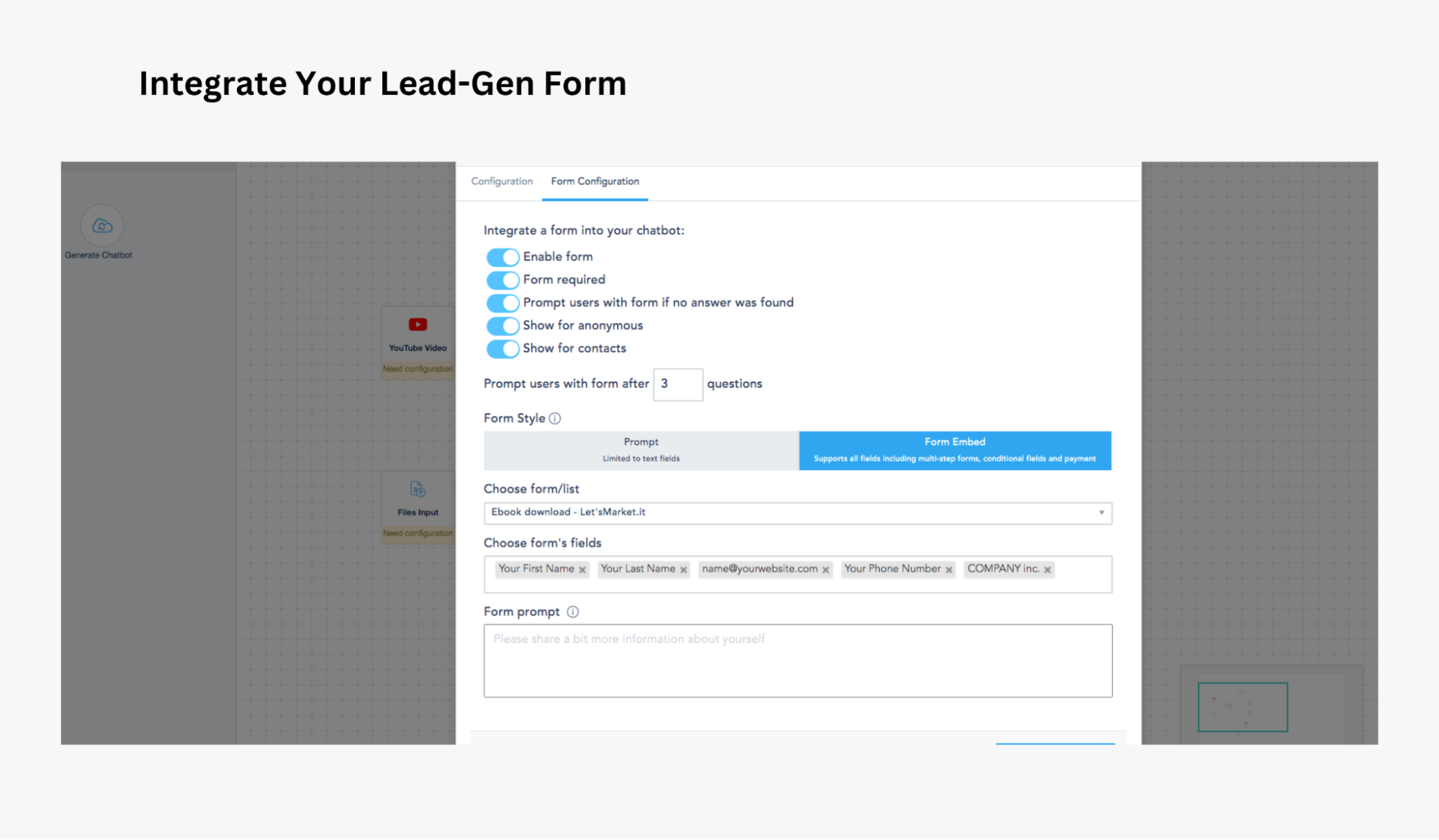

Forget the old-school phone calls and endless email chains. When it comes to financial services, clients want faster, more efficient communication. That’s why AI-powered chatbots are stepping in to make financial interactions more seamless. Besides answering customers’ questions, AI chatbots also provide real-time, personalized financial advice to users, enhancing the entire client experience. Let’s take a closer look at some ways you can use AI-powered chatbots to improve client communication in your financial services company. But first … Chatbots make communication faster, easier, and more convenient for everyone involved. They’re always available, save time, and make things run smoothly. Here are the top benefits of using them in financial services: Chatbots don’t need breaks — they’re always on. So no matter the time, customers get immediate answers. Imagine a scenario where a finance platform like Brex uses a chatbot that adapts to user behavior — offering tailored prompts based on the page the visitor is viewing. In the image below, for example, the user’s reading a blog post about the best online business banks. So the chatbot mentions, “Saw that you’re interested in online business bank accounts! If you have questions, feel free to ask.” It also provides three relevant call-to-action (CTA) prompts, like “Schedule a demo, ” and a section for the user to type in their own question. Choosing the best online business banks is crucial for businesses leveraging these tools to ensure seamless financial operations. Online business banks offer automation features, integrations with AI-driven platforms, and real-time transaction tracking, enabling financial service providers to manage payments, invoicing, and client accounts efficiently. As you can see, by combining AI-powered chatbots with a reliable online banking solution, businesses can enhance customer interactions while maintaining smooth and secure financial processes. Speaking of personalization, chatbots can learn about your customers’ preferences and offer them useful suggestions. For example, they can recommend options for student loan refinancing or share budgeting tips based on past behavior. (This makes managing finances simpler, without needing to talk to a human.) No one likes waiting on hold. Chatbots give fast answers and handle simple tasks like scheduling or account updates. This saves businesses money and lets human agents focus on more complicated issues that need a personal touch. Chatbots are great for improving customer interactions. But only when they’re set up correctly. Here’s how to make sure your chatbot adds real value: Before you launch a chatbot, figure out what you want it to do. Should it answer questions, provide financial advice, or help with banking tasks? A clear role helps it fit smoothly into your business. Also, make sure the chatbot’s tone matches your brand. A formal business might have a professional-sounding chatbot. But a more casual brand might go for something friendlier. A chatbot should be easy to use, not frustrating. Keep things simple with quick response buttons and natural language processing options. If someone asks, “What’s my balance?” The chatbot should understand it just like it would a question like “How much money do I have?” Guide users through interactions, too. If a customer asks about credit card options, the chatbot should walk them through the process step by step. No confusing links or info dumps. (Your chatbot should make customers feel like they’re having a natural conversation.) A chatbot is only as good as the info it has access to. For instance, when you connect it to your remote work software, banking software, or customer accounts, it should provide real-time data on things like: Without integration, a chatbot is just a fancy FAQ page. But when connected, it can pull up past interactions, remember preferences, and make conversations feel personal and efficient. Your chatbot needs to understand financial terms just like a human agent. That means knowing things like APR, credit utilization, wire transfers, and exchange rates. It should also make these things easy to understand; a crucial feature for clients looking to improve financial literacy through guided digital experiences. If a customer asks about compound interest, your chatbot should break it down simply, instead of using a confusing technical definition. The more it simplifies complex topics, the more valuable it becomes to everyday users. Financial data is sensitive, and customers need to trust that their info is secure. Make sure your chatbot follows strict security measures like encryption, authentication, and data masking to prevent leaks. Compliance is also a must. Whether it’s GDPR, PCI DSS, or any other regulation, your chatbot must meet the required standards. A chatbot that gives wrong answers or frustrates customers is a problem. Before launching, test it in real-world scenarios. Have people ask tough questions, try to break them, and see how they handle different situations. (Check this on multiple device types and screen sizes, too.) If users get stuck or frustrated, adjust the responses until they flow smoothly. Customers don’t just use your website. They message on social media, use mobile apps, and even interact through voice assistants. Ideally, your chatbot should be available across all of these platforms — whether on Facebook Messenger, WhatsApp, or your app. And wherever else customers try to reach you. Chatbots are great for handling routine tasks, but some questions need a real person. If a chatbot can’t answer something or a customer is frustrated, it should seamlessly transfer the conversation to a human agent. This is so important to the customer experience. A good rule of thumb is to let AI handle simple tasks and route complex issues to agents. This will help you create a balanced system that gives customers quick answers and a personal touch when needed. Speaking of engagement … Here are some ways you can enhance customer engagement when setting up your AI chatbot: Provide smart financial advice in real time Your chatbot can do more than chat. It can also help customers make better financial decisions. For instance, the chatbot might suggest a lower-rate option or a balance transfer if someone is paying high credit card interest. Or, if a customer has extra cash sitting idle, it might suggest alternative ways to grow their wealth, like exploring investment options with Abacus Global. The chatbot can assist clients with everything from account inquiries to financial product recommendations. This allows the company to provide a more efficient, 24/7 customer service experience. A company like Abacus Global could use a chatbot to assist clients with account inquiries and product recommendations — streamlining customer service while offering 24/7 support. Set up alerts and reminders Nobody wants to miss a bill payment or realize too late that their savings goals are off track. Chatbots can send helpful reminders about upcoming due dates, alert customers to unusual transactions, or suggest ways to save money. Program timely nudges like these to help customers stay on top of their finances without feeling overwhelmed. Integrate easy appointment scheduling Booking a meeting with a financial advisor should be simple. Instead of waiting on hold or navigating a clunky website, customers should be able to just type in, “I need to talk to a mortgage specialist,” or “Book a demo” and your chatbot should instantly pull up available times. Let’s review some more quick tips below. To keep your chatbot effective, try these tips: Need more support? Keep reading. Managing customer communication in the financial world can be tricky. Clients want fast responses, clear guidance, and secure interactions. But traditional systems don’t always keep up. That’s where VBOUT’s AI chatbot solves a major problem. It helps finance businesses handle customer queries, automate tasks, and deliver real-time insights. Without long wait times or clunky processes. Not all chatbots are created equal. Some just answer basic FAQs or immediately point you to a human agent. VBOUT takes it further. You can set up the chatbot to act like a true financial assistant that enhances client communication and helps you book appointments. Here are some of VBOUT’s chatbot’s most notable features: With VBOUT’s AI chatbot, financial institutions can streamline communication, reduce manual support work, and create a smoother client experience. A chatbot’s success depends on how much it improves customer interactions. Financial institutions should focus on the following key metrics to track its effectiveness. The right data shows whether a chatbot is truly helpful or just another layer of automation customers avoid.

The best way to assess performance is through analytics and customer feedback. Businesses can:

VBOUT provides detailed reports on chatbot interactions to show you what’s working and needs improvement. These valuable insights can help you fine-tune responses and continuously improve the user experience. Ultimately, a chatbot should do more than just answer customer questions. It should make financial communication effortless, secure, and personalized. And you can set that up with VBOUT. AI is changing how financial service companies talk to clients, and chatbots are leading the way. (They’re here for the long haul to make communication faster, easier, and more accurate.) But no matter how smart a chatbot is, it still can’t beat the personal touch of a human. The best results come from using both — AI for speed and humans for understanding. If you want to improve client communication, save time, and increase efficiency, it’s time to invest in AI-powered chatbots. Want to see how our chatbot can streamline your client communications? Schedule your personalized demo today — it’s free and only takes 15 minutes. VBOUT’s chatbot is a great place to start. About the author Shane Barker is a digital marketing consultant who specializes in influencer marketing, content marketing, and SEO. He is also the co-founder and CEO of Content Solutions, a digital marketing agency. He has consulted with Fortune 500 companies, influencers with digital products, and a number of A-List celebrities.!Benefits of using chatbots for client communication

Always available, always ready

Personalized conversations

Faster responses, lower costs

8 key techniques for making chatbots work effectively

1. Define your chatbot’s role

2. Design the chatbot to support an optimal user experience

3. Connect chatbots with existing systems

4. Teach your chatbot financial lingo

5. Keep data safe and follow regulations

6. Test before going live

7. Offer chatbot support across multiple channels

8. Combine AI with human agents

How to enhance customer engagement through AI chatbots

Best Practices for Ongoing Chatbot Maintenance and Improvement (A quick checklist!)

How VBOUT’s conversational AI chatbot platform makes financial communication easier

What makes VBOUT’s chatbot different?

Measuring the impact of chatbots on client communication

What to measure

Track:

Tools for measuring success:

How VBOUT tracks chatbot performance

The future of AI chatbots in financial services

Don’t forget to share this article

Related articles

Nothing found.